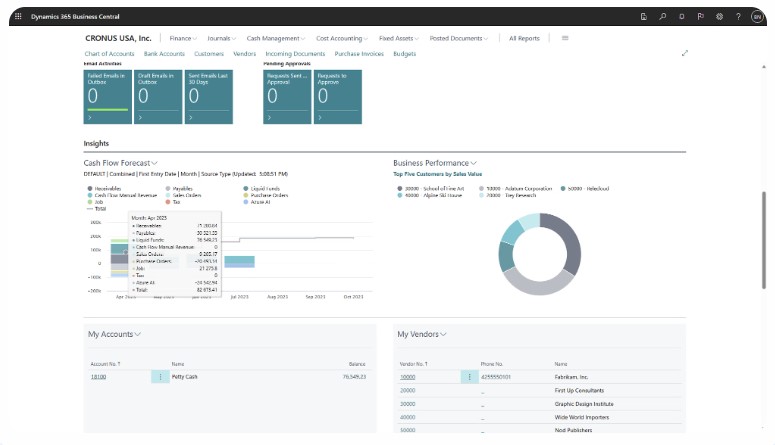

Effective cash flow management is critical to the success of any business. Dynamics 365 Business Central offers embedded tools to help organisations gain better visibility into their financial health and make informed decisions. From real-time forecasting to advanced analytics, this solution empowers businesses to stay ahead of their cash flow needs. In this blog, we explore the cash flow forecasting capabilities in Business Central, demonstrating how its technology can streamline financial planning and ensure sustainability.

1. Understanding Cash Flow Forecasting in Business Central

Dynamics 365 Business Central provides out-of-the-box cash flow forecasting capabilities designed to help businesses monitor, predict, and manage their cash inflows and outflows. It pulls data from multiple sources, such as:

- Accounts receivable

- Accounts payable

- Bank accounts

- General ledger

- Sales and purchase orders

This centralised approach eliminates the need for external tools and manual data entry, reducing errors and saving time.

Key Features:

- Automatic Data Integration: Business Central consolidates financial data automatically, ensuring forecasts are always accurate and up-to-date.

- Customisable Settings: Tailor your forecasting model to include specific accounts, budgets, or additional revenue streams.

- Real-Time Insights: Instantaneously view cash positions based on dynamic, real-time updates from your operations.

2. Creating a Powerful Cash Flow Forecast

With Dynamics 365 Business Central, building a robust cash flow forecast is straightforward. Here’s how you can maximise its capabilities:

Step 1: Set Up a Cash Flow Forecast

Business Central allows you to configure a cash flow forecast tailored to your organisation’s needs:

- Define your cash flow accounts and map them to specific ledger accounts or dimensions.

- Include expected payments and receipts from sales and purchase orders.

- Incorporate external sources, such as loans or investments, using manual entries.

Step 2: Automate with Intelligent Predictions

Leverage the power of AI-driven insights to enhance your cash flow forecasting:

- Predict customer payment patterns with the Late Payment Prediction feature.

- Use built-in AI models to estimate revenue streams and expenses.

Step 3: Visualise with Advanced Reporting

Dynamics 365 integrates seamlessly with Power BI, enabling you to create stunning visual dashboards. Highlight trends, compare scenarios, and drill down into specific transactions directly from your forecast.

3. Benefits of Business Central’s Embedded Cash Flow Functionality

Real-Time Accuracy

Unlike static spreadsheets, Business Central updates forecasts in real time as new transactions are recorded. This ensures decision-makers always have access to the most current financial data.

Scalability

Whether you’re a small business or a growing enterprise, the system adapts to your scale and complexity, allowing you to include advanced elements like:

- Multiple currencies

- Intercompany cash flow

- Seasonal fluctuations

Enhanced Collaboration

Team members can collaborate on forecasts with shared access, ensuring alignment between finance, sales, and operations teams.

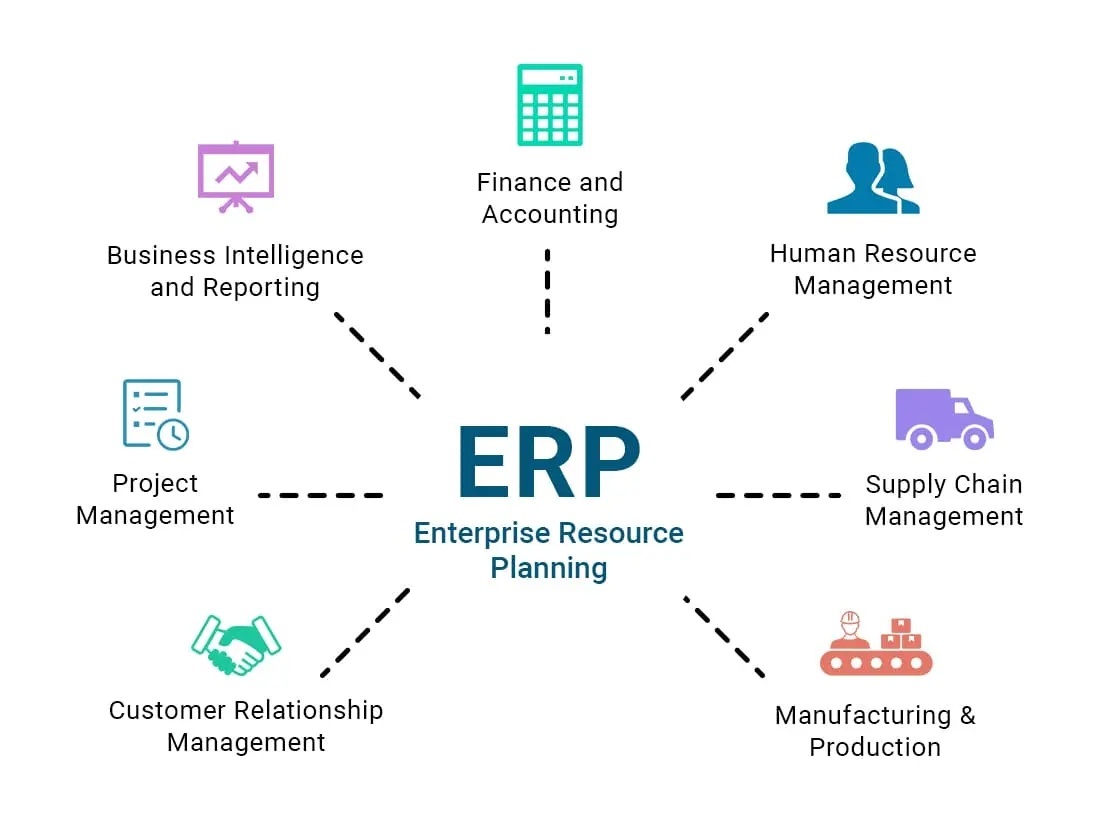

Integration with Other Modules

Business Central’s cash flow forecasting is integrated with its broader ecosystem, including inventory management, payroll, and project planning, for a holistic view of your business.

4. Going Beyond Basic Forecasting

Dynamics 365 Business Central goes further than simple cash flow tracking by enabling businesses to plan for the future with advanced tools:

- Scenario Planning: Test different financial scenarios to prepare for potential risks or opportunities.

- Budget vs. Actual Analysis: Compare forecasts with actual performance to refine accuracy over time.

- Automation: Automate repetitive tasks like data consolidation and reporting to free up resources for strategic planning.

5. Practical Tips for Optimising Cash Flow Forecasting

To get the most out of Business Central’s cash flow tools, consider these best practices:

- Leverage Historical Data: Use historical cash flow trends to improve forecasting accuracy.

- Update Regularly: Regularly refresh your forecasts to reflect recent transactions and market conditions.

- Collaborate Across Teams: Engage finance, sales, and procurement teams to ensure comprehensive inputs.

- Customise Dashboards: Use Power BI to create role-specific dashboards that highlight metrics relevant to each department.

6. Why Choose Dynamics 365 Business Central for Cash Flow Forecasting?

Business Central stands out as a premier ERP solution due to its integrated and intelligent approach to cash flow management. Its embedded functionality ensures you don’t need to rely on third-party tools, while its AI-driven predictions and reporting capabilities set it apart from traditional methods.

1. Integrated and Real-Time Financial Insights

Business Central consolidates data from multiple financial modules—accounts receivable, accounts payable, and general ledger—to provide a unified view of cash flow. This ensures:

- Real-Time Updates: Cash flow forecasts dynamically update with new transactions, reducing reliance on static spreadsheets.

- Seamless Data Integration: Integration across sales, purchase, and inventory modules ensures a complete picture of financial operations.

This integration empowers businesses to monitor liquidity and avoid cash shortfalls with confidence.

2. Advanced Predictive Analytics

Business Central leverages AI-powered tools to enhance cash flow forecasting:

- AI Predictions: Features like Late Payment Prediction use historical data to forecast customer payment behaviours.

- Scenario Planning: Businesses can model various financial scenarios to prepare for market changes or unexpected expenses.

These tools provide deeper insights, enabling proactive financial decision-making.

3. Embedded Role-Centric Tools

Business Central includes role-specific dashboards for finance professionals. Key features include:

- Cash Flow Worksheets: Allows detailed tracking of payables, receivables, and budgets in one interface.

- Interactive Charts: Visual tools like timeline sliders and filtering options simplify the analysis of cash trends over time.

Such role-centric tools promote collaboration and transparency across teams.

4. Customisation and Scalability

Whether you are a small business or a multinational corporation, Business Central adapts to meet your needs:

- Customisable Models: Forecasts can include specific accounts, external revenue sources, and multi-currency considerations.

- Scalable for Growth: As businesses grow, they can incorporate more complex financial processes, such as intercompany cash flow and seasonal adjustments.

5. Automation and Efficiency

Automating cash flow management saves time and reduces errors:

- Scheduled Updates: Automatic updates ensure forecasts are always accurate and current.

- Integration with Power BI: Create visually engaging reports to share with stakeholders or drill into details for decision-making.

Automation eliminates repetitive tasks, allowing finance teams to focus on strategy.

6. Trusted Ecosystem

Microsoft Dynamics 365 Business Central operates within the secure and reliable Microsoft Azure cloud environment. Benefits include:

- Compliance and Security: Built-in compliance tools ensure adherence to global standards.

- Scalable Infrastructure: Azure’s scalability supports businesses of any size, without additional infrastructure investment.

Conclusion

Cash flow forecasting in Dynamics 365 Business Central provides the clarity and control businesses need to thrive. By leveraging its advanced capabilities, companies can not only manage their current finances effectively but also plan confidently for the future. Whether you’re a small business or a global enterprise, Business Central’s tools empower you to make smarter financial decisions.

Ready to optimise your cash flow? Contact us to learn how Dynamics 365 Business Central can transform your financial operations.